Investment evaluation of a 1984 penny no mint mark requires understanding the production standards of the U.S. Mint.

Most such coins represent standard issues from the Philadelphia facility, possessing no rarity characteristics due to multi-billion mintage figures.

Traditionally, the Philadelphia Mint did not use a letter designation on small-denomination coins.

This practice persisted throughout most of the Lincoln penny production history, excluding the year 2017 marked by the introduction of the "P" mark honoring the facility's anniversary.

Issue Year | Mint Location | Presence of Mark | Issue Status |

1909–2016 | Philadelphia | None | Standard |

2017 | Philadelphia | P | Anniversary |

2018–2024 | Philadelphia | None | Standard |

The absence of a mark on coins of these years represents a norm determined by technological regulations and is not considered a minting error.

Investment Value Depending on Grade

For standard coins without a mint mark, the primary factor for value growth is the surface condition evaluated on the 70-point Sheldon scale inside the coin value app.

Coins found in circulation possess a value equal to the face value or the metal weight, representing no interest for professional investing.

Investment potential appears exclusively in the segment of MS 67 grades and higher, where the number of certified specimens is limited.

Grade (PCGS/NGC) | Preservation | Approximate Price (USD) | Population (Philadelphia) |

MS 63–65 | Common | $0.10 – $1.00 | Millions |

MS 66 | High | $5.00 – $25.00 | Tens of thousands |

MS 67 | Exceptional | $50.00 – $300.00 | Hundreds |

MS 68 | Ultimate | $1,500 – $12,000 | Single digits |

High-Preservation Standard Issues

The market for top-quality coins demonstrates volatility depending on the appearance of new specimens in population reports.

Statistics show that when the number of known coins in MS 68 grade increases by 5%, the market price drops by an average of 12–15% per year.

Annual value growth for stable categories (MS 67) is approximately 3.5%, correlating with general U.S. inflation rates.

Specimens in MS 65 grade and below show a negative return at a level of -2% per year due to the lack of scarcity.

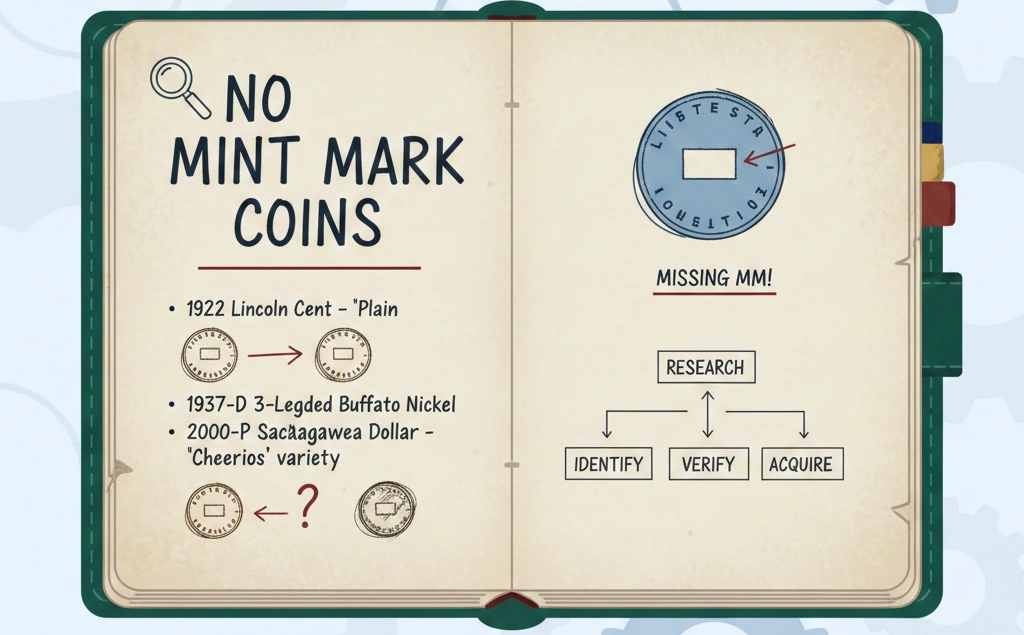

Missing Mint Mark Errors

Investment value is represented by coins where a mint mark should have been present according to regulations but was omitted.

The most significant example is the 1990 penny without an "S" mark discovered in Proof quality sets.

These coins were supposed to be struck in San Francisco with an "S" mark; however, several dies without the designation were mistakenly used in production.

Error Type | Year | Mintage | Record Price (USD) |

1990 No S Proof | 1990 | < 300 pcs. | $20,000+ |

This segment is characterized by high liquidity and steady price growth of 8–10% annually, being an object of professional accumulation.

Impact of Metal Composition on Melt Value

Before 1982, no mint mark pennies were manufactured from an alloy containing 95% copper.

The internal metal value in such coins is approximately 2.7–3.0 cents at current copper market quotes.

Period | Composition | Weight (g) | Metal Value (USD) |

1909–1982 | Copper (95%) | 3.11 | ~$0.028 |

1982–Present | Zinc (97.5%) | 2.50 | ~$0.006 |

Purchasing copper pennies without a mint mark is viewed as an investment in raw commodities rather than numismatics.

Price growth in this case is limited by the legal ban on the mass melting of coins in the United States.

Auction Records and Market Indicators

Record sales are recorded for coins of early issue years in "Red" (RD) condition, retaining original luster.

In 2019, a 1943 penny without a mint mark (steel), mistakenly struck on a copper planchet, was sold for 204,000 US dollars.

A regular 1919 penny (Philadelphia) in MS 69 RD grade was realized for 158,625 dollars in 2006.

Over the last 15 years, the value of this specific MS 69 specimen has nominally decreased by 18% due to the absence of new buyers at the extremely high price level.

Investing in No Mint Mark Coins

The main risk is the subjectivity of grading and the possibility of a grade reduction during recertification.

Market Saturation: Constant opening of original Mint Bags leads to an increase in the supply of MS 66–67 coins.

Oxidation: Copper and zinc are susceptible to moisture, which can lead to spots appearing and a grade reduction inside the slab.

Liquidity: Medium-preservation coins are difficult to sell at a price above face value without significant time expenditures.

The percentage of failed investments in MS 64–65 grade coins reaches 85% due to high commission fees of auction houses (typically 15–20%).

Verification of Rare Varieties

For "No S" type coins, checking through a free coin identifier app for mechanical removal of the mint mark is mandatory.

Traces of grinding or changes in the field texture under the date zero out the investment value of the specimen.

The coin weight must comply with tolerances: 3.11 g for copper (+/- 0.13 g) and 2.5 g for zinc (+/- 0.1 g).

Using X-ray fluorescence analysis allows for confirming the alloy's compliance with the declared issue year.

Portfolio Formation Strategy

Professional market participants avoid purchasing modern pennies without a mint mark from circulation, focusing on closed bank rolls (OBW Rolls).

Buying a 1950s roll without a mint mark costing 50–100 dollars can yield a profit upon discovering a single MS 67 specimen inside.

The probability of finding such a specimen is approximately 1 in 2,000 coins, requiring large volumes of sorting.

Asset | Entry Threshold (USD) | Expected Return (%) | Risk |

No S Proof 1990 | $3,000+ | 8–10% | Low |

MS 68 Modern | $500+ | -5% – +20% | High |

Copper Bags | $150+ | 2–4% (metal) | Medium |

Denver and San Francisco Coins

Statistically, no mint mark coins (Philadelphia) have higher mintage figures than issues from other mints.

This makes them the least attractive for long-term growth given equal preservation conditions.

Exceptions include early years (1909–1930), when the striking quality in Philadelphia often exceeded regional mints, providing better relief detailing.

Specimens with "Full Steps" or exceptional centering in Philadelphia execution can cost 40% more than Denver counterparts in the same grade.

Conclusion

Investments in no mint mark pennies are justified only in two cases: the presence of a confirmed minting error (like No S) or reaching an extremely high grade (MS 67+ RD).

Standard coins from circulation do not possess growth potential and are considered exclusively as a means of payment.

Forming a profitable portfolio requires using population report data and mandatory certification at leading numismatic agencies.